India’s wealth management landscape is in the middle of a profound shift. What was once a relationship-driven, paper-heavy industry is rapidly evolving into a digitally enabled, intelligence-driven ecosystem.

With rising investor expectations, expanding digital infrastructure, and accelerating adoption of cutting-edge technology, wealth management in India is becoming more accessible, efficient, and personalized than ever before.

Digital Adoption Is Fueling WealthTech Growth

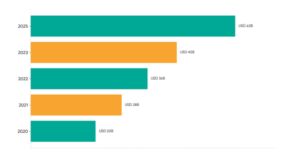

The scale of this transformation is best reflected in the numbers.

According to a recent EY India analysis, the Indian WealthTech market has surged from USD 20 billion in 2020 to a projected USD 63 billion by 2025, highlighting the exponential pace at which technology-led investing is expanding (EY).

Source: EY Wealth & Asset Management reports

Reports from PwC and Business Standard indicate that the country now hosts one of the world’s largest digital populations, a foundation that enables seamless access to online advisory platforms, investment marketplaces, and wealth apps.

Investor preferences have evolved just as quickly. Platforms like Gitnux and WifiTalents note that a significant share of wealth-management clients now prefer digital onboarding over traditional paperwork, and many are more comfortable seeking advisory online than scheduling in-person meetings.

Convenience, control, and accessibility have become central to the modern wealth experience.

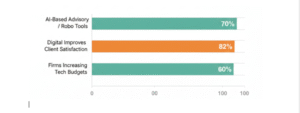

Technology Integration Is Reshaping Advisory Models

Beyond simple digitization, technology is transforming how advice is delivered. As of 2025, approximately 70% of wealth-management firms in India have adopted AI-driven advisory models or robo-advisory tools. These solutions offer real-time insights, risk scoring, and personalised asset allocation, allowing wealth managers to scale expertise while maintaining precision.

Client impact is clear: nearly 82% of firms report improved customer satisfaction due to digital tools (Gitnux). Automation has not only enhanced advisory but also strengthened backend operations. Leading firms, including those surveyed by Wipro, now rely on AI for risk assessment, compliance checks, analytics, and portfolio monitoring, improving transparency and reducing human error.

Digital Wealth Is Reaching New Investor Segments

The digital wealth revolution is not limited to affluent investors. Affordable platforms and simplified onboarding have opened the doors to India’s expanding mass-affluent and retail investor base. Insights from Mintbyte and A Junior VC show that younger investors, often first-time earners, now prefer starting their wealth journeys through digital channels, aided by goal-based advisory tools and intuitive interfaces.

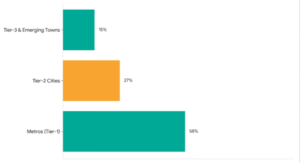

Source: PwC(PricewaterhouseCoopers)

What’s more, digital platforms are enabling deeper financial inclusion in smaller cities. Ken Research and Mintbyte highlight a sharp increase in investor participation from tier-2 and tier-3 locations, where traditional wealth management services were previously inaccessible. Technology is breaking geographical barriers and democratizing wealth creation on a national scale.

Source: Mint Investments research

Even at the top end of the spectrum, digital adoption is rising. Many private banks and wealth institutions are now offering hybrid service models for HNIs and UHNIs, blending human expertise with digital-first tools to deliver personalized yet efficient wealth solutions (Hubbis).

What Tech-Driven Wealth Management Means for Today’s Investors

For investors, this transformation translates into meaningful advantages:

- Efficiency & Convenience: Instant onboarding, digital KYC, paperless processes, and real-time tracking streamline the investment journey.

- Personalisation & Insight: AI-powered advisory tailors portfolios to goals, risk appetite, life stage, and market shifts, bringing precision once available only to elite clients.

- Inclusive Access: Wealth solutions are no longer concentrated in metros or among high-income groups; anyone with a smartphone can start building wealth.

- Greater Transparency: Digital dashboards and automated reports offer clarity and control, replacing the opacity of traditional wealth practices.

What Lies Ahead for India’s Wealth Management Industry

As digital transformation accelerates, it will continue to reshape how wealth is created, managed, and delivered. Looking ahead, we can expect:

- A rise in retail participation across mutual funds, equities, and alternative assets.

- More hybrid advisory models that combine sophisticated technology with human insight.

- Product innovation, including micro-investing, goal-based portfolios, and digital-first alternatives.

- Continued democratization of wealth, making structured investing accessible to every aspiring Indian.

As investors navigate a rapidly evolving financial landscape shaped by digital adoption and shifting market dynamics, technology-enabled wealth solutions are set to become a defining pillar of next-generation portfolios.

Want to explore how digital innovation can elevate your wealth strategy?

Connect with InCred Wealth today and uncover personalised, tech-driven investment solutions designed around your goals.

Related Posts

December 2, 2025

Trade Tariffs & Counter-Tariffs: Is Financial Coercion Becoming the New Normal?

The international trading community is experiencing a rise of protectionism and…

October 28, 2025

India-UK Free Trade Agreement: A Strategic Leap for Growth & Investment

India and the United Kingdom have signed a historic Free Trade Agreement (FTA)…

May 26, 2025

Gold vs. Silver in 2025

2025 is turning out to be quite a challenging year for most investors and fund…

May 5, 2025

Sensex VS Wall Street

In a fascinating turn of events, the unstable global situation due to…

April 21, 2025

RBI’s Latest Rate Cut: What It Means for Debt Investors & Borrowers

Welcome to our blog series on investing styles, in this series, we explore…

December 28, 2023

2023 A tale of resilience amidst mounting challenges

2023 has been a year of resilience, with markets and economies adapting to…

December 6, 2022

Time for Indians to Rethink the Wealth Paradigm

India is at a pivotal moment to rethink its wealth paradigm, focusing on…

September 20, 2022

Understanding the Basics of Strategic and Tactical Asset Allocation

As an investor, you are focused on one thing – maximising your returns,…