Opportunities in Unlisted Equities & the Pre-IPO space!

The unlisted equities market offers a unique opportunity to invest in early-stage companies at valuations well below their long-term potential. This allows investors to access high-growth businesses before they go public, with the potential for significant rewards over time.

Although unlisted equities can enhance a portfolio, they require a long-term view and careful consideration due to their unique risks and liquidity challenges. For those willing to invest early and spot innovation, this market provides opportunities not found in public markets.

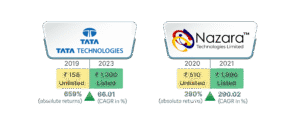

Potential to unlock significant value:

Some Unlisted companies can offer an opportunity to participate at a significant discount to their potential long-term value.

Exclusive Access to High-Potential Businesses:

New-age companies, challengers and disruptors would always first appear in the unlisted space and if you have an eye for a business with great future potential, the unlisted equities space can offer access to such exclusive financial opportunities that are not available in the public markets. These high-potential private market opportunities are typically reserved for institutional or accredited UHNI/HNI investors and should be availed only through trustworthy platforms when considering investing a large ticket size.

Long-Term Horizon:

Unlisted equities often appeal to investors with a longer-term investment horizon. These investments can provide substantial returns over time as companies with sound businesses grow and mature, aligning with long-term financial goals and investment strategies.

Not without risk:

Since Unlisted Shares are not traded on an exchange, they are fairly illiquid and best suited for those prepared to hold them for a few years or until the IPO. The offered/ traded price of unlisted securities in the secondary market can be dependent on a variety of factors across demand / supply / market sentiment. One must remember that the unlisted secondary market stock price can at time also end up being higher than the future Initial Public Offer / offer for sale/ primary issuance price and investors must have the appetite to bear such risks.

Disclaimer: InCred Wealth and Investment Services Private Limited (InCred Wealth) is an AMFI registered Mutual Fund Distributor. InCred Wealth also acts in the capacity of distributor of various Financial Products. InCred Wealth does NOT provide investment advisory services in any manner or form and is not a SEBI-registered research analyst or advisor. InCred Wealth is not under any obligation to undertake any due diligence to assess and advise on the risks or suitability for any unlisted shares. Above shall not be deemed to constitute as distribution, an offer to buy or sell or the solicitation of any offer to buy or sell any unlisted securities and no advice, representations, warranties or recommendations are being made to the recipient by InCred Wealth in respect of any unlisted securities or transaction therein. Investment in unlisted securities is subject to various risks, including but not limited to liquidity risk, regulatory risk, market volatility etc. and there is a possibility of loss of entire committed capital. Offered/ traded price of unlisted security in secondary market is based on demand / supply/ market sentiment and other factors. Pre-IPO shares are unlisted securities, but this should not be interpreted as InCred Wealth guaranteeing or confirming that an IPO takes place for such shares. The decision to proceed with an IPO is entirely at the discretion of the issuing company, which may choose not to go public. The recipient should independently evaluate the transaction, carry out the required due diligence and understand all the risks associated with any unlisted shares transaction upon due consideration of his/her/its own risk appetite, investment needs and financial situation, and the recipient shall be solely responsible for all transaction related decisions. It is highly recommended that potential investors consult with their own financial advisors on the same. Information /opinions contained in this communication have been obtained from sources believed to be reliable, but no representation or warranty, expressed or implied, is made that such information is accurate or complete. This communication should not be taken in substitution for the exercise of independent judgement by any recipient. InCred Wealth or any of its group companies or its officials shall have no liability in any way for any loss or damage, direct or indirect, arising from the use of this information.

Related Posts

November 13, 2025

Gold MLDs: Strategic Wealth Creation

As investors are craving safety and high returns, we are seeing the emergence…

October 23, 2025

Specialized Investment Funds (SIFs): The Modern Bridge Between Mutual Funds and Alternatives

Specialized Investment Funds (SIFs) represent a compelling new category in the…

December 11, 2024

Hybrid Funds – A trend that looks like it is here to stay

Hybrid funds have gained significant popularity, with a 74% surge in their…

April 5, 2024

The High-Risk, High-Reward Conundrum: Why Private Market Is Both Attractive and Enigmatic

The private market offers unique investment opportunities with high potential…

July 24, 2023

Private Credit An important addition in HNI investment portfolios

Private credit has become a key addition to HNI portfolios, offering attractive…

December 6, 2022

Target Maturity Funds

Target Maturity Funds (TMFs) offer a predictable investment horizon, combining…

April 26, 2022

Private Equities – Gunning for a larger pie in U/HNI Investment Portfolios

A decade back, the world was at the cusp of innovation and entrepreneurs across…

March 10, 2021

PMS and Mutual Funds – A comparison worth making

By comparing both the Market, investors can develop a long-term investment…